The stock market rallied after the U.S. Commerce Department eased some restrictions on companies doing business with Chinese telecom giant Huawei Technologies.

The government said last night that it would allow Huawei to continue purchasing American-made products for its existing telecom networks until Aug. 19. The momentary let-up in trade tensions with China and Huawei helped the stock indexes post gains today. The Nasdaq Composite index was up 1.08 percent while the Dow and S&P 500 indexes rose 0.77 percent and 0.85 percent respectively. The Entrepreneur Index™ gained 0.71 percent on the day.

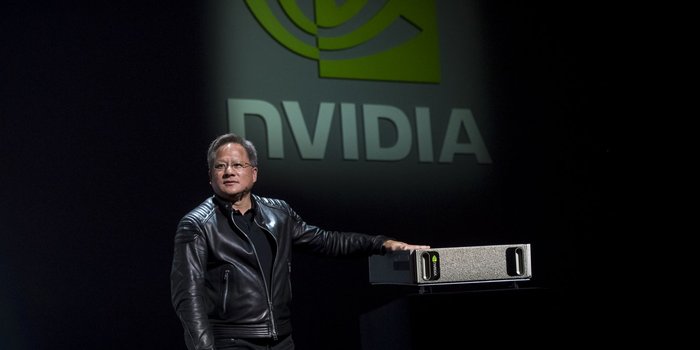

Semiconductor chip-makers, slammed in the last couple of trading sessions, had the biggest gains in the technology sector. NVIDIA Corp. (2.18 percent) and Analog Devices (2.44 percent) were both up sharply. Other good gains were posted by TripAdvisor Inc. (1.78 percent), Netflix (1.77 percent) and Facebook (1.15 percent).

Regeneron Pharmaceuticals had a good gain today, rising 2.44 percent. The drug-maker reported poor financial results earlier this month and has seen its stock drop 17 percent so far this year.

Retailer O’Reilly Auto Parts was also up 2.44 percent. While many retailers have warned that the trade war and rising tariffs will hurt their businesses, investors were buying today. Ralph Lauren Corp. (1.83 percent), L Brands (1.66 percent) and Bed Bath & Beyond (1.59 percent) were all up nicely.

The REIT sector was also strong today. All nine REITs on the index had gains. Mall operator Macerich Company, which is down four percent on the year and 24.6 percent in the last twelve months, had the biggest in the group, rising 2.19 percent.

Investors had no appetite for food stocks today. Tyson Foods (-1.54 percent) and J.M. Smucker Company (-0.55 percent) had the biggest declines on the index. Only ten other stocks on the index fell today, most posting small losses.